News is spreading fast that Sonder has publicly released their Series D pitch deck. They were “advised not to do so” and chose to do so anyways. I believe as competing brands fight for demand/market share and supply/inventory its important to Sonder to become the clear leader in the space; not only to be recognizable to consumers but also to real estate owners. The problem is that the space is poorly defined and other than the occasional announcement of large funding rounds many of the companies remain relatively unknown to wider audiences. By releasing this deck Sonder not only favorably compares itself directly to competitors to gain a leg up but also takes the first move to define the space, their competitors in the space, and the niche’s important metrics.

RevPARTY has found a few key takeaways from the pitch deck that can be applied to the industry as a whole and help branded short-term rental companies become relevant in this emerging industry.

How Industries Develop

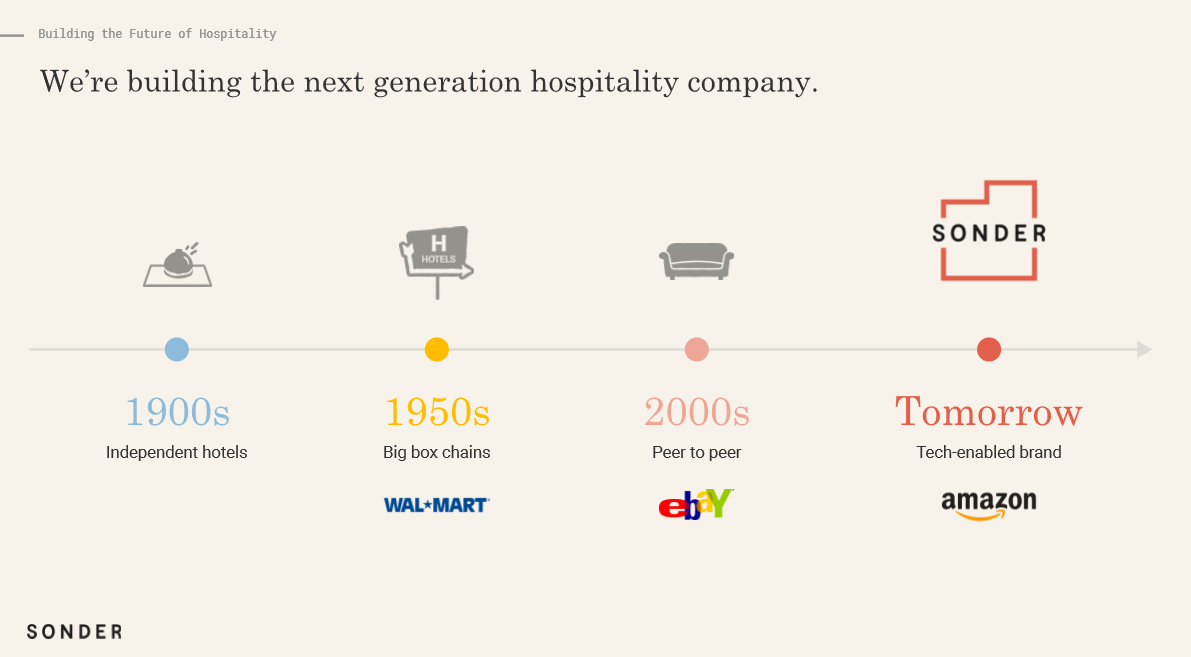

Slide 7 in Sonder’s pitch deck compares the development of the vacation rental industry to the development of retail stores; showing the progression from big box chains, to peer-to-peer marketplaces, to on-demand and tech enabled marketplaces.

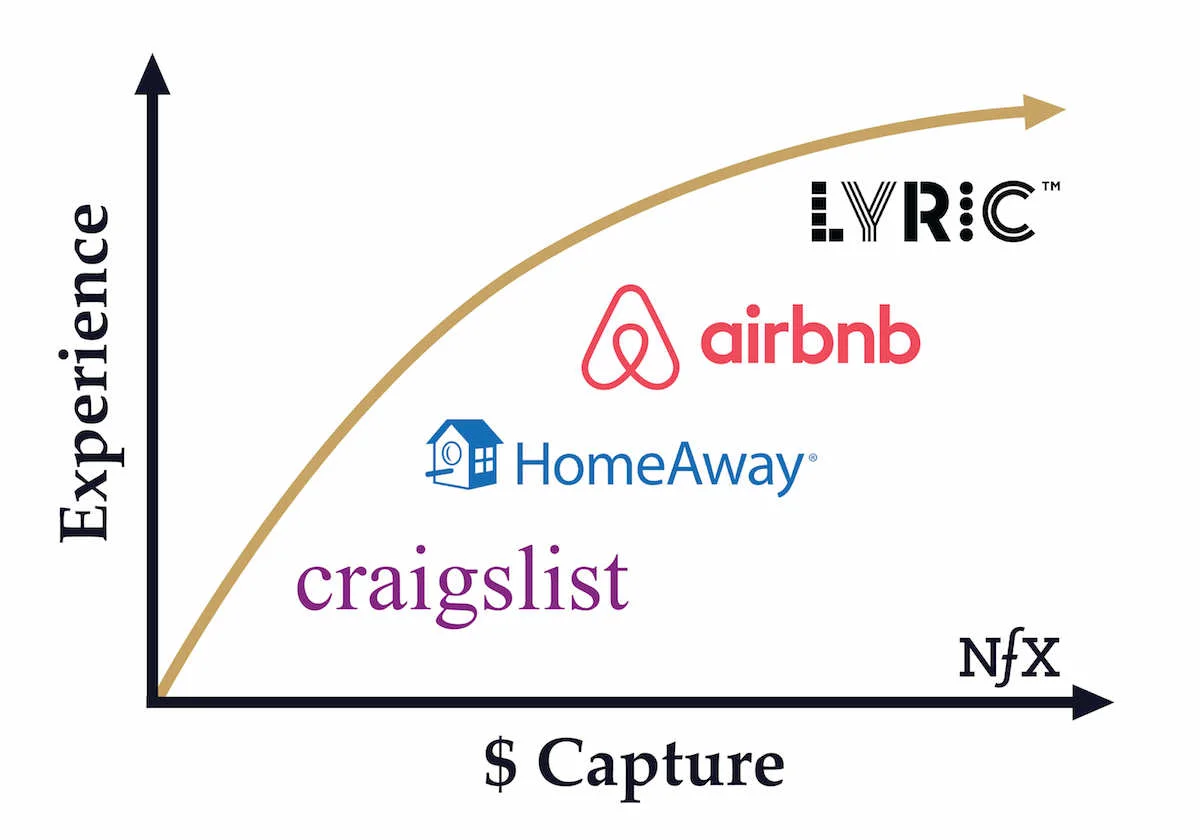

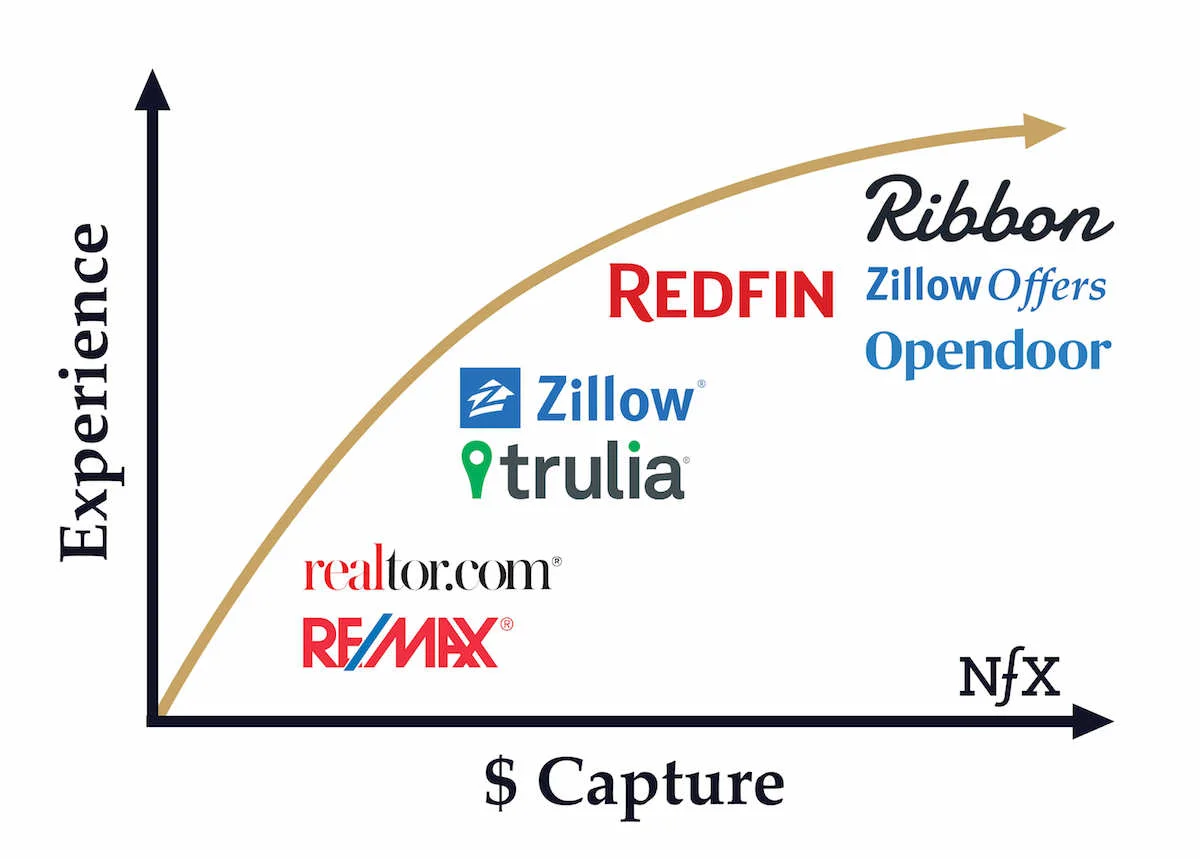

This immediately drew a comparison to an article by Pete Flint on fintech development where he compares the hospitality and real estate online marketplaces in their evolution from sources of lead generation to fully transactional marketplaces.

Technology is enabling vertical integration, marketplaces of size and scale to be efficient, and simplifying the consumers journey through metasearch, combined products and reviews, and easy comparison shopping. In order to stay competitive, branded vacation rental companies will have to do the same and leverage their internal efficiencies to maximize their digital presence.

Many Companies are Focusing on the Same Things

The second thing that jumped out to me is how similar Sonder’s pitch deck was to other pitch decks I’ve seen throughout the industry: both decks that have been shared with me and decks I’ve helped build.

Whether through market forces and VC direction or through knowledge and experience gained by operating in the space, the short-term rental industry is conforming to a standard set of metrics it deems to be KPIs. By releasing the pitch deck from their unicorn round Sonder has:

- Added legitimacy to these metrics being important because “If that many investors gave them that much money these things must matter”;

- Distributed a template that others in the space are likely to imitate, making these metrics commonplace industry wide; and

- Put a stake in the ground as a comparison which will cause investors evaluating other opportunities to ask “How do you compare to Sonder in these areas?”

Whether you love it, hate it, or are indifferent these metrics are here to stay:

- Unit economics;

- Supply acquisition and pipeline;

- Direct booking percentage.

While some of these metrics are somewhat standard across startups or common in the traditional hotel industry, they are now benchmarks for short-term rentals. I would also argue that comparison metrics to hotels and real estate also drive value such as ADR, occupancy, RevPAR, repeat booking percentage, cost of a turn, and IRR.

In order to be competitive across these KPIs brand will have to ensure low costs through scale and deep penetration in markets (note Sonder mentioned they are profitable in all markets with >100 units), high supply deal conversion rate by targeting pre-launch properties through enterprise partners, and great reviews and customer service handled by a centralized call center that drives repeat business.

Furthermore, many players are focusing on the growing millennial travel trends as a growing space and touting their tech enablement through apps, accessory services, and data driven decisions. This could be true for any startup seeking funding but it holds true in this space as well.

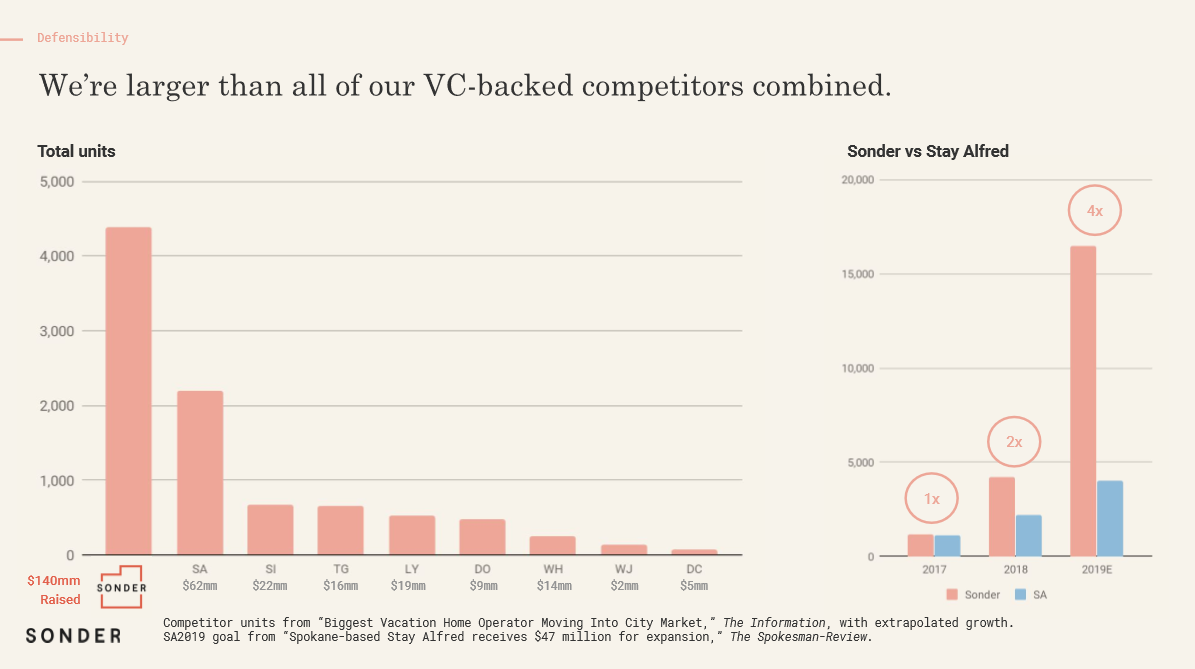

Companies Tend to Overestimate Their Competitors Size

Its hard to know exactly how big your competitor is. I get it. In a startup market where funding is freely flowing and competitors are fighting for market share companies tend to overestimate the size of their competitors. Sonder has focused on unit and market expansion since day one and is by far the largest. However, I know many of the unit counts they estimated for their competitors is overstated … in some cases double the actual units.

Another interesting not is while they may be larger than all of their other VC backed competitors combined, they also had $140M in funding while all of their competitors combined had $149M. Not necessarily a great callout on the capital utilization.

It’s Not All About Growth, Its Growth in Growth

New companies, startups, and players in growing markets are expected to grow. They’re expected to grow fast and growing faster than your competitors is obviously a great quality to have. However, it’s becoming important to go one level deeper to gain an edge.

Investors care about growth in growth (if there are any economists out there, we’re talking differentials or logged growth). At what rate is your growth rate growing?

Its great to be growing fast but investors want to know that you’ll be growing even faster and they’re catching a ride on the rocket ship. They want to know that you’ve created efficiencies that will immediately be applied to their capital and generate returns. The classic J-curve graphs for revenue, guests, unit supply, etc. are great ways to show this. Another way in the short-term rental space is to show product launches: is the time it takes to make money from a new unit or new market decreasing?

Sonder focuses on all of these throughout their deck to really sell their upside potential.

Awesome Spaces in Awesome Places

It seems fairly obvious but quality pictures of quality spaces is a requirement. Simply enough, the same things that attract guests also attract investors. Guests want to stay in a beautiful and stylish room in a great location and they need to be able to see this through quality pictures on websites and OTAs. Investors also want to invest in products that are cool and that they would be proud to own; awesome spaces in awesome places.

Don’t skimp on styling and photography when designing and selecting your space or when you optimize your listing. It may cost some in the short run but it could cost you a lot more in the long haul.

The Meta Concept

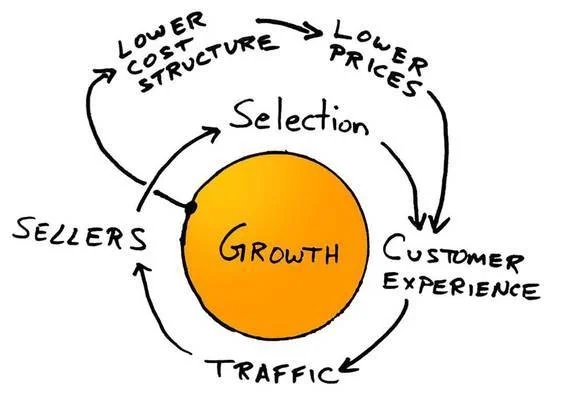

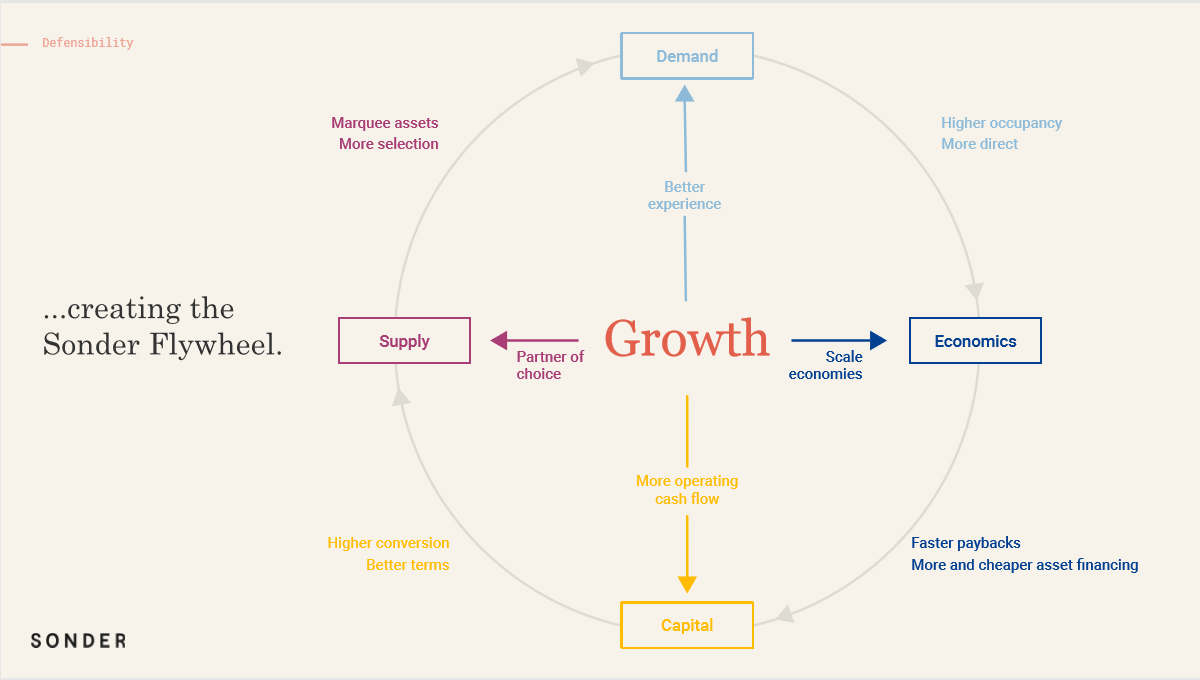

People love a meta concept, a driving principle, an insightful framework. They want to be a part of the next Facebook, Amazon, or Uber. They want to invest in a visionary who conceptualizes something they never could in simple enough terms that they can.

Circular concepts seem to be just the way to do that. Amazon had its “circle of life” and Sonder has its “flywheel”.

All in all, Sonder’s pitch deck sets the stage for what’s to come. It defines the battlefield for future market share and VC dollars. It’s allowed them to draw a line in the sand and place a stake in the ground simultaneously.

Here at RevPARTY we’ve driven these KPIs before. We’ve shaped and developed vacation rental revenue management strategies and pricing tactics to help our clients win victories on the short-term rental battlefield. And we’re more than happy to share our war stories and help you be victorious as well.