Recently, I came across a conversation between one of my past clients and a heavy hitting industry expert. They were pondering the questions we’ve all had this past year:

Why did the vacation rental industries not take the same hit the hotel industry did?

Why did STR companies in urban markets (like Stay Alfred, Lyric, and Domio) go under during the pandemic?

Why didn’t well-funded companies (like Sonder and Vacasa) who were aggressively pursuing growth not buy inventory from the failing companies?

What are the winners and survivors doing that makes them so special?

All of them are interesting questions, but they’re not specific to the pandemic. The pandemic was merely a catalyst that magnified existing structures and strategies that help a short-term rental company be successful or not. While some question the validity of the master lease model, and it does have its challenges, there are takeaways that can help any vacation rental portfolio grow, weather market shocks, and improve profitability.

Survival of the Fittest

While we often think of “survival of the fittest” as a way to reference natural selection in Darwin’s theory of evolution, it was actually first used by Herbert Spencer to describe economies and businesses. The business that is best adapted to the economy will survive, and those that are bad market fits or perform poorly will naturally “die” and leave the economy.

Many parallels exist between survival of the fittest in an economy and in nature and we’ll look to explore them here to answer the questions that prompted this post:

Existing Environment & Competition: The economy and market are equivalent to a natural environment and competition exists in both ecosystems

Extinction Event: This is some sort of external force or exogenous shock that restricts resources or eliminates companies that can’t adapt

Adaptations: These are the things that determine survival, what changes were made to what a company is or how it operates to allow its continued existence in the marketplace.

We’ll briefly review how each of these affected the short-term rental industry and then dive into a few quick case studies of some company successes and failures in 2020.

Existing Environment

Vacation rentals were positioned to better adapt to the pandemic before the pandemic even started.

The first reason is location, location, location. Many vacation rentals are located in non-urban markets, areas that became popular during quarantine as it gives people the ability to space out and enjoy a comfortable isolation. Moreover, many of those buildings are single family homes which only adds to the ability to isolate, avoid public spaces and human traffic, and maintain cleanliness.

Second, a lot of vacation homes are also located in luxury markets or are higher-end units which saw less of an impact from the shrinking pandemic travel market. Luxury accommodations performed strongly as they target guests looking to enjoy a staycation that also have a strong willingness to pay.

Finally, many vacation rental management companies utilize technology that serve as extraordinary pandemic precautions.

The existing environment was favorable to vacation rentals. Vacation rental market locations were attractive, many had desired building types, and luxury or higher-end accommodations were in demand which all contributed to a stronger than hotel performance from the short-term rental industry. Even master-lease models in urban environments and widely distributed non-urban vacation rentals utilized technology that created a quarantine friendly process for guests which only added to that momentum.

Extinction Event

Covid-19 brought very specific challenges to the vacation rental industry and its important to note that this wasn’t just a stretch of “really bad business.”

First, there was an approximately two-month period when there was for most intents and purposes no revenue being generated.

Second, there was an extended period in most markets and portfolios where there was partially reduced revenue.

Finally, the market demand changed. Not just overall demand, but the kind of inventory guests were looking for. Guests wanted drive-to locations that didn’t require flights or cross-country trips. Guests were looking for longer stays where they could work and play. Guests were also looking for isolation: single family homes in non-crowded areas with low contact procedures during the stay.

Adaptations

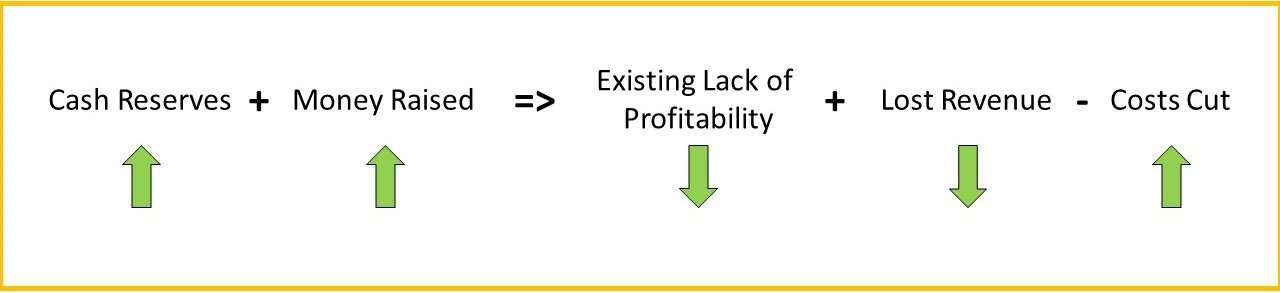

In order to survive, companies had to float two months of carrying costs and either stay profitable or absorb any losses incurred during the months of reduced revenue. They could do this with cash in the bank, via raising more money, through cutting costs, and/or by adapting their demand generation. But at the end of the day every company had to maintain this equation:

Cash Reserves and Money Raised must be greater than or equal to any lack of profitability and lost revenue minus any cost cutting.

Cash Reserves and Existing Lack of Profitability are pre-pandemic conditions. The rest are all adaptations during the crisis.

As Cash Reserves, Money Raised, and Cut Costs increase, a company has a better chance of surviving the pandemic. As Lost Revenue and lack of profitability (both numbers that subtract cashflow and cash reserves from the business) decrease, a company has a better chance of surviving.

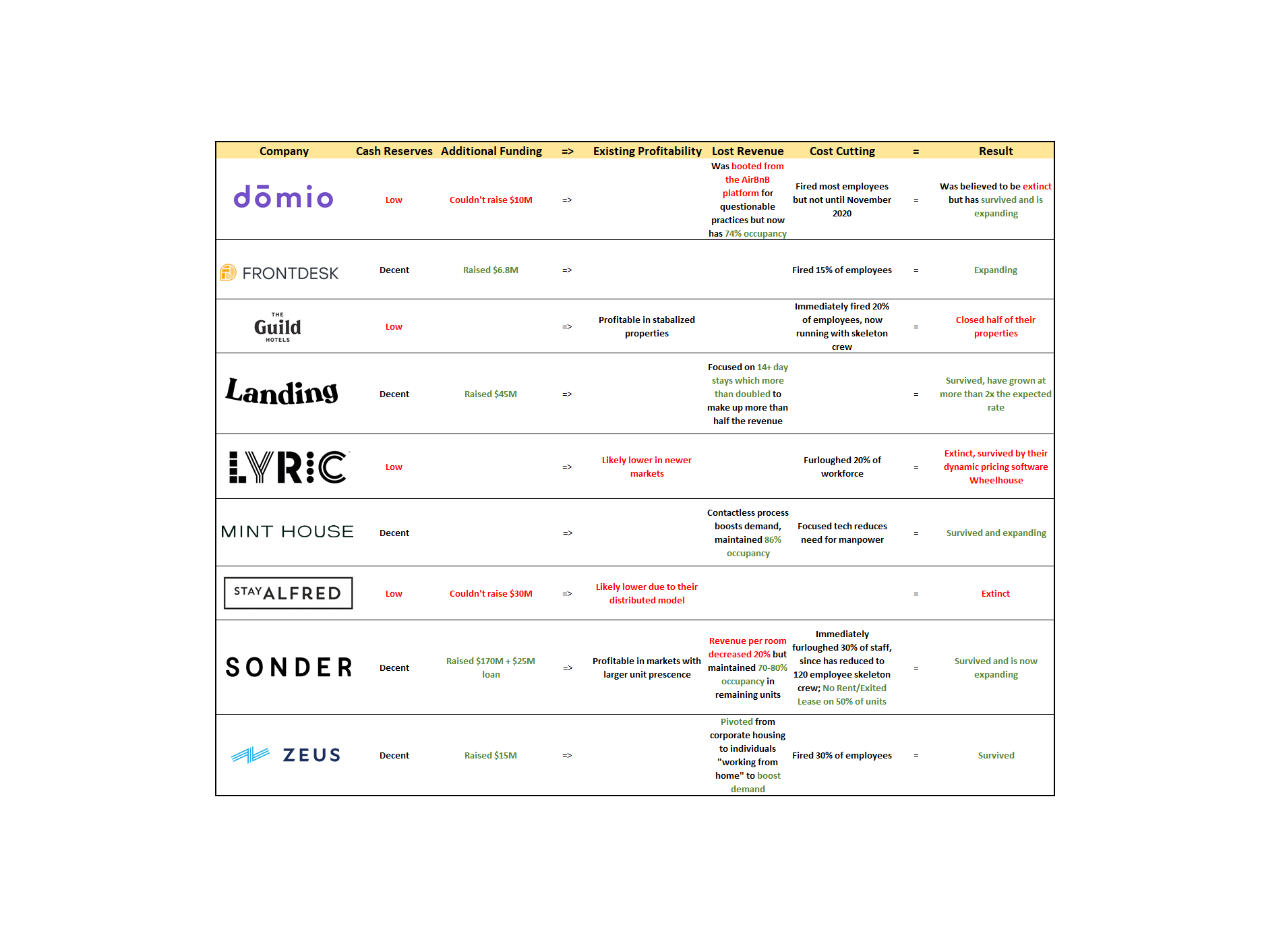

After we examine how different companies attempted to maintain this equation in the case studies below, we’ll circle back to the specific adaptations that kept certain companies alive and let others go extinct.

Case Studies

Domio

Domio had 1000 units across four markets. They attempted to pursue tech solutions early on in response to the pandemic and touted a 100 point cleaning process to try and recover demand. However, they laid off a majority of their staff in early November after they couldn’t raise the $10M needed to keep their workforce running. Moreover, after some questionable business practices AirBnB removed their listings from the platform.

Their listings have since been reinstated by AirBnB after the departure of their CEO and co-founders and they’ve rebounded to 74% occupancy. Domio is pursuing a bankruptcy alternative and now plans to open three new properties and two new markets.

FrontDesk

FrontDesk is acquiring Stay Alfred inventory at a rapid pace. Claims their “asset light” model allows them to reach profitability and increase growth quickly. Stay length increased 22% from 2019 to 2020. Took over Stay Alfred in New Orleans, Indianapolis, Pittsburg. They claim to boost building occupancy by 2-10% with their FLEX platform. They operate with a subscription fee and then rates for short term rentals at any of their locations.

Landing

Landing raised $45M (including investor Maveron who is also invested in The Guild). They originally planned to expand to 35 cities but have expanded faster than planned and are now in 75 cities. Stays 14 days or longer used to only be 25% of their business but since the pandemic has made up 60% of their business.

Lyric

Lyric, who had 400 units and once operated 600 units across 14 cities, reacted to the pandemic immediately by furloughing 20% of their workforce. Lyric must have been a bit low on cash reserves and struggling with profitability in their rapidly expanding market count because they quickly made the decision to cease operations and pivot to their dynamic pricing tool, Wheelhouse.

Lyric tended to operate full floors so the dense concentration of units should have improved their profitability over the more distributed units of Sonder and Stay Alfred. However, many of their units and markets were extremely new, likely not yet profitable, and the rapid expansion may have ran down cash reserves.

Mint House

Even prior to the pandemic Mint House had no front desk, no concierge station, and no back office but utilized smart phones for check-in, smart locks for room access, smart devices in the unit for everything from tv to exercising, and contactless communication. This digital approach has allowed Mint House to maintain an 86% occupancy across its 600 units in 11 markets and stay profitable. They recently inked a deal to take over some of Lyric’s old units and have grown their inventory by 75% since August 2020 … up to 1,000 units now.

Stay Alfred

Stay Alfred had 2500 units in 33 cities and 271 employees before it went belly up. Unfortunately, they were unable to sell off their assets and also couldn’t raise the $30M they needed to continue operating.

Sonder

Sonder entered the pandemic with over 5,000 units in 35 cities and a healthy bank account from previous funding rounds.

As soon as the pandemic happened, they cut their workforce by 1/3. They also cleverly put force majeure clauses in their contracts and was able to stop rent or terminate leases on over 50% of their units. This did lead to some legal disputes from San Francisco to New York City but has seemed to be largely successful.

Sonder has always bet on tech but they “accelerated” their tech focus on contactless check-in since the pandemic started. They then further shrunk their workforce to a skeleton crew of 120 employees. These cost cutting measures combined with their cash reserves allowed them to stay afloat. They continue to claim 70-80% occupancy (depending on the interview) during the pandemic; which is undoubtably boosted by their inventory reduction, even though they have claimed in court filings that Covid has "crippled Sonder’s efforts to draw potential tenants to the premises.".

Following their successful navigation of crisis mode, Sonder raised an additional $170M round amidst the pandemic, brought back 100 employees, and put Sonder back “into growth mode.” They’ve recently expanded their footprint in three Canadian cities, Seattle, Philadelphia, and the United Kingdom.

Most recently, Sonder received a $23M loan (and partial grant) from the Canadian government in December. They’ve promised 700 additional jobs to walk back their previous layoffs and just this week made some strategic, C-suite hires to signal even more growth ahead.

Zeus Living

Zeus Living had units in D.C., New York, LA, Boston and Seattle. After realizing guests were searching for their properties not in a city center, they pivoted to renting to individuals as corporate travel decreased. Remote workers make up 25% of their business now, partially supplementing demand and allowing their occupancy to reach 85%. Zeus Living had to cut both its workforce and valuation by 50% but was able to raise $15M to stay afloat. They then expanded to markets like Austin, Denver, and Miami.

Conclusion: The Vacation Rental Genome

As was predictable from our survival equation above, the four adaptations below influenced whether a company made it through the pandemic or not. They start laying the blueprint for a successful vacation rental … or the vacation rental genome:

Companies that were more profitable normally were more likely to survive. It extended their runway and minimized their need to reduce cost or lessen the revenue impact. It was easier to achieve if the portfolio was densely distributed as opposed to widely dispersed;

Those with prior large funding rounds that built cash reserves or who could raise funding during the pandemic were more likely to survive;

Those that effectively cut costs were able to survive. They could do this by getting out of their leases/rent, reducing their headcount, or lengthening the average length of stay to drive down variable costs;

Those not in urban markets were more likely to survive as the pandemic forced guests to leave densely populated areas and escape to single family homes.

When we boil everything down to these few survival skills, it becomes evident why bigger, well funded companies didn’t begin swooping up inventory. While trying to manage their own reduced profitability and lengthen their own runway, companies couldn’t risk spending their valuable cash reserves and reducing their runway to acquire units that likely had poor profitability to begin with (some combination of low revenue or high costs).

However, as the pandemic lessens and demand begins to increase again we are seeing the companies that survived raising rounds and trying to acquire inventory and expand to new properties and markets … they just waited until they were in the clear to begin doing so. They also are likely more selective in the inventory they’re considering as the focus on profitability had to only intensify.

In the end, there were two adaptations that always had the same result and may provide the greatest insight on how to navigate crisis like this in the future.

First, reducing head count never allowed a company to survive. While some of the companies that did survive did also reduce head count, those companies also took other drastic measures. The companies trying to solely cut costs and payroll all closed their doors (or at least a lot of their doors).

Second, if a company could raise money during the pandemic then they always survived the pandemic. Receiving more money directly lengthens a company’s runway regardless of any other business components. Moreover, receiving funding during the pandemic is likely a proxy for other parts of the business performing well or other hidden/lurking variables such as profitability, expansion opportunities, market performance, etc.

Bottom line? Profitability, cost cutting, and fund raising are all essential adaptations of the vacation rental genome that allowed companies to survive the pandemic. An emphasis should be placed on raising capital as it always ensured success and a company should never rely on cutting headcount alone to lengthen their runway because it never works.

Check out a comparison of all the companies and how they handled the pandemic below and whenever you’re facing a crisis, let RevPARTY help you navigate the path to success.

This article was sourced using well-known industry resources, various publicly available articles, and candid conversations with multiple individuals that have intimate knowledge of internal company happenings. We only drew conclusions after combining facts and figures with the narrative, interviews, and RevPARTY’s industry experience.